Unknown Facts About Palau Chamber Of Commerce

Table of ContentsNot known Incorrect Statements About Palau Chamber Of Commerce Palau Chamber Of Commerce Fundamentals ExplainedThe Greatest Guide To Palau Chamber Of CommerceThe Only Guide to Palau Chamber Of CommerceExamine This Report about Palau Chamber Of CommerceNot known Factual Statements About Palau Chamber Of Commerce Top Guidelines Of Palau Chamber Of Commerce3 Simple Techniques For Palau Chamber Of Commerce

The Facts About Palau Chamber Of Commerce Revealed

donation size, when the donation was contribution, who donated, how much, a lot they just how to your website, web site) Finally, donation pages make web pages convenient and hassle-free for basic donors to contributors!

You might also think about running an email project with routine newsletters that allow your visitors understand about the magnum opus you're doing. Be certain to collect email addresses and various other pertinent data in a proper means from the start. 8. 5 Deal with your individuals If you have not tackled employing and onboarding yet, no worries; currently is the time.

There are several donation software available, and not using one can make on-line fundraising quite ineffective or even impossible. It is very important to select one that is straightforward for you to set up and also manage, is within your spending plan, and uses a smooth donation experience to your donors. Donorbox is the most inexpensive contribution system out there, charging a tiny system fee of 1.

Palau Chamber Of Commerce Things To Know Before You Get This

To read more, have a look at our short article that talks even more extensive regarding the major nonprofit funding resources. 9. 7 Crowdfunding Crowdfunding has actually turned into one of the crucial means to fundraise in 2021. Consequently, nonprofit crowdfunding is getting hold of the eyeballs nowadays. It can be utilized for details programs within the company or a general donation to the cause.

During this step, you may desire to consider turning points that will suggest a possibility to scale your not-for-profit. As soon as you have actually run awhile, it is essential to take a while to think of concrete growth goals. If you haven't already created them during your planning, create a collection of key efficiency indications and also turning points for your not-for-profit.

Rumored Buzz on Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in different states in the US: Beginning a Nonprofit Frequently Asked Questions 1. How much does it set you back to start a nonprofit company?

For how long does it take to establish up a nonprofit? Depending upon the state that you remain in, having Articles of Incorporation authorized by the state federal government may use up to a couple of weeks. As soon as that's done, you'll have to request acknowledgment of its 501(c)( 3) standing by the Internal Income Solution.

With the 1023-EZ type, the processing time is commonly 2-3 weeks. Can you be an LLC and also a not-for-profit? LLC can exist as a nonprofit limited liability company, nevertheless, it ought to be totally had by a single tax-exempt nonprofit company.

Palau Chamber Of Commerce Can Be Fun For Everyone

What is the difference in between a foundation and a not-for-profit? Foundations are generally funded by a family members or a business entity, but nonprofits are moneyed with their revenues and also fundraising. Foundations usually take the cash they started with, spend it, as well as then disperse the money made from those financial investments.

Whereas, the money a nonprofit makes are used as running prices to fund the company's objective. This isn't necessarily real in the case of a structure. 6. Is it hard to begin a not-for-profit organization? A not-for-profit is a company, but starting it can be quite intense, calling for time, clarity, and also money.

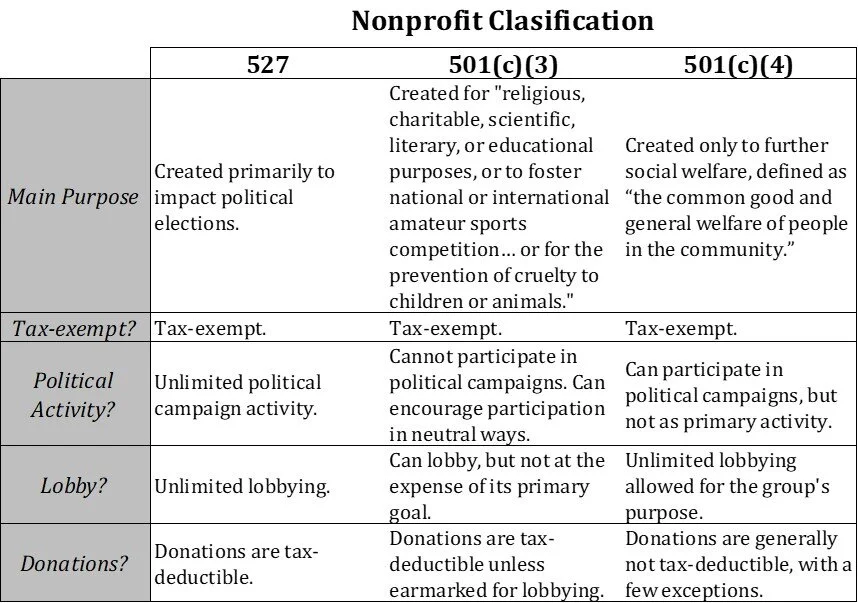

Although there are numerous steps to start a not-for-profit, the obstacles to entry are fairly couple of. 7. Do nonprofits pay taxes? Nonprofits are exempt from government income taxes under area 501(C) of the IRS. Nonetheless, there are certain conditions where they may my link require to pay. If your nonprofit makes any revenue from unrelated activities, it will owe income taxes on that amount.

Not known Facts About Palau Chamber Of Commerce

The role of a not-for-profit organization has actually always been to create social modification and lead the means to a much better globe., we prioritize remedies that assist our nonprofits raise their donations.

By much the most common kind of nonprofits are Area 501(c)( 3) companies; (Section 501(c)( 3) is the part of the tax obligation code that accredits such nonprofits). These are nonprofits whose mission is charitable, spiritual, educational, or scientific.

This category is vital since exclusive foundations go through strict operating policies as well as guidelines that do not relate to public charities. For instance, deductibility of contributions to a personal structure is extra limited than for a public charity, as well as personal structures undergo excise tax obligations that are not enforced on public charities.

What Does Palau Chamber Of Commerce Mean?

The lower line is that personal foundations obtain a lot worse tax obligation therapy than public charities. The primary difference in between exclusive foundations and public charities is where they get their economic assistance. An exclusive foundation is site here usually controlled by a specific, household, or company, and gets the majority of its revenue from a few donors and also investments-- a good example is the Costs as well as Melinda Gates Foundation.

Most structures just give cash to various other nonprofits. As a sensible matter, you require at least $1 million to begin a private structure; otherwise, it's not worth the difficulty as well as expenditure.

Other nonprofits are not so lucky. The IRS originally presumes that they are personal structures. Palau Chamber of Commerce. However, a brand-new 501(c)( 3) organization will be classified as a public charity (not a personal structure) when it uses for tax-exempt status if it can show that it fairly can be anticipated to be openly supported.

The Best Guide To Palau Chamber Of Commerce

If the IRS classifies the nonprofit as a public charity, it keeps this status for its very first five years, despite the general public assistance it in fact obtains throughout this moment. Starting with the nonprofit's sixth tax original site obligation year, it has to reveal that it satisfies the public support test, which is based upon the support it receives during the existing year and also previous four years.